|

| Source: Flickr |

The word “entrepreneurship” is generally associated with entrepreneurs; people who organize and manage enterprises, usually with considerable initiatives and risks.

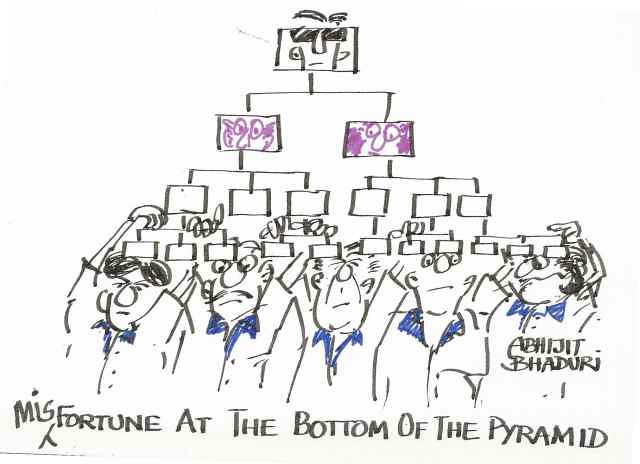

The societal pyramid classifies people as per their financial status. Its bottom comprises the poorest people, while the middle class (in sync, with its name) is placed in the middle, and the privileged are on the top. It is comparatively easy for people in the upper portion of the pyramid, who already are affluent, to take the entrepreneurial plunge. Moreover, they also have financial institutions and useful contacts, which makes the path much easier to walk. The sole point in favor of the poor is that akin to an actual pyramid, the social pyramid also has most of its mass (population) at the bottom. For entrepreneurs, belong to the bottom class, it is easier for them to relate and connect with people, the engine of any business. As entrepreneurs originating from the same background, they are usually better molded to deal with their workers and in some cases, even consumers.

Entrepreneurship: Reasons

The reasons for entrepreneurship for different classes vary in sync with their circumstances. For the rich, it’s a way to strike out from their peers and background; a way to express their ideas, talents, and creativity. Furthermore, some of them even venture into entrepreneurship for the kick only.

The middle class normally looks for white color jobs, but some misfits do try to break the shackles. They get out of their monotonous lives and take the plunge.

The poor are left with limited choices. They have no option but to live the destitute lives of their previous generations. Starting from their childhood, they have to dwell in poverty for their entire lives. Aching from that lingering and inescapable pain, a lot of them wish to write a different script for their children. Mostly without resources or coveted qualifications, living in the perennial fear of starvation, entrepreneurship is not only the only way for them to survive but sometimes even a compulsion.

A Familiar Story

It is a familiar story for most entrepreneurs, belonging to the poor class. They start early, sometimes even before they have reached their teens, to earn their bread by working for someone else. They gradually pick up the tricks of the trade. They also consciously or unconsciously hone their interpersonal skills. Interpersonal skills help them to create a much-needed contact network. Thus, armed with the requisite skills, they take the Herculean task of changing their lives.

The Only Way

Entrepreneurship is the only way for these aspiring poor. While growing up, most of their parents couldn’t afford a good education. As a result, they mostly turn into semi-skilled laborers. The most harmful part is that many among them get automatically molded to the miserable lifestyle of their previous generations. Only a few of them are smart enough to understand that the small wages they earn would not suffice (both for their children and themselves). Only a handful of imaginative yet practical minds among them realize that in order to survive the ordeal they have to think out of the box.

Clutches of Loan Sharks

The way to secure a loan for entrepreneurs, belonging to the bottom class, used to be tricky. Previously, they mainly use to knock on the door of local moneylenders. These moneylenders, actually loan sharks in disguise, were their only hope to raise a starting capital. These loan sharks used to charge unbelievably high-interest rates, carving away the profit margin of these poor entrepreneurs. Moreover, these lenders sometimes used to arm-twist poor entrepreneurs into terms tilted in favor of the formers. Also, there was the ever-present issue of deliberate account manipulation to further cheat the compelled entrepreneurs.

Microfinance: A New Lifeline

These aspiring poor now have a new lifeline in the form of microfinance. According to a recently published report, in India, there are around 5.8 crore unique users aided by micro-financial institutions. Moreover, the micro-finance loan portfolio has swelled to Rs 2,59,377 crores as of March-end, this year.

Challenges with Microfinance

Bad debts

One of the major challenges with microfinance is bad debts. The primary reason for bad debts is that poor people can afford few (or none) assets in the form of collateral securities. Microfinance institutions tend to focus on increasing the customer base. This automatically creates the payment recovery problem. To curb bad debts, the institutions should intensify their attention to analyze their potential clients and their repayment capacity.

Defaulter problem

The defaulter problem starts with poor identification and risk analysis on the part of microfinance organizations. Another major factor is the entrepreneur’s (here the aspiring poor's) entrepreneurial capabilities. If their entrepreneurial skill-set is not up to the mark then the chances are that it will cast trouble for both them and the lender(s). Due to their poor upbringing and the discouraging environment, they more often suffer from a lack of self-esteem, belief, and confidence. They also lack the education and experience to succeed in their endeavors.

High-interest rates

The major hurdle in the way of entrepreneurs working by borrowing capital from microfinance institutions is the high-interest rates. These interest rates range from 30% to 100% per annum. The institutions urge that the high-interest rates are on the grounds of transaction costs and sustenance.

Management problem

The basic management problem with microfinance is the expense of managing consumer accounts, which usually generates negligible revenue. The process becomes unsustainable if the revenue generated per account is lesser than the cost incurred by the organization.

Marketing problem

The marketing problem with microfinance is that it is based on myths and fantasies. It doesn’t show the actual picture that; in reality, it is only marginally improving the lives of aspiring poor (the entrepreneurs at the bottom of the pyramid). People donating to these organizations automatically assume that their aid would metamorphose the lives of the poor, whereas reality paints a different and picture.

Scalability problem

Most microfinance institutions support people who are already involved in an enterprise. The rest of the aspiring entrepreneurs face the challenge of generating ideas, which are buyable by these institutions.

Due to the lack of education and budget, the ventures started by such entrepreneurs generally consist of no or low technologies. They certainly can’t compete with industries equipped with cutting-edge technologies and infrastructure. As a result, they have considerably low scalability. To counter this problem, both government and NGO institutes have started providing them with the necessary training and courses.

Microfinance is a boon to entrepreneurs at the bottom of the pyramid. However, generally, industrious but poor people realize, in a hard way, that it’s tricky and incredibly difficult, to escape from the bottom layer. They still have to pay substantially high-interest rates (to microfinance institutions) in comparison to other classes, who are qualified for conventional banking institutions. The poor also have few social contacts and support systems to assist them. They almost have no collateral security to bank upon. Also, it’s a fact that most of these entrepreneurs (aspiring poor) are not entrepreneurs by choice. They will gladly accept employment if they can make a good living. Entrepreneurship at the bottom of the pyramid is more often than not a compulsion for these persisting pioneers.

No comments:

Post a Comment